What Does Bad Credit Financing Do?

Table of ContentsThe Single Strategy To Use For Bad Credit FinancingThe Bad Credit Financing StatementsThe Buzz on Bad Credit FinancingThe smart Trick of Bad Credit Financing That Nobody is DiscussingThe Best Guide To Bad Credit FinancingFascination About Bad Credit FinancingThe 20-Second Trick For Bad Credit Financing

Consumers with poor credit rating might get reduced rates of interest since they're setting up collateral. If you default on a secured financing, your lender might legitimately confiscate your security to recuperate the cash. And if your loan provider does not recover the price of the financing by redeeming your possessions, you might be in charge of the difference.This approach can make it less complicated for consumers with negative credit scores to be eligible for a financing, as it decreases the key consumer's danger. If you're incapable to make payments on this sort of finance, not just can your lending institution effort to gather from you, they can likewise try to accumulate on the lending from your co-borrower.

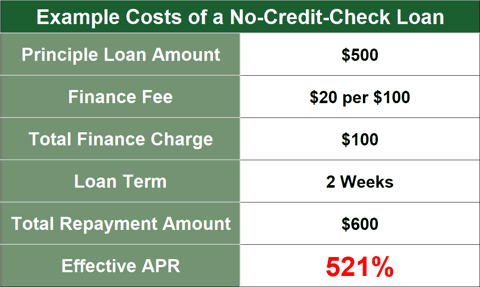

Cash advance lendings are considered a more uncertain kind of lending, with astoundingly high fees as well as rate of interest. These lendings are commonly much less than $500 and also are anticipated to be paid back within 2 to four weeks. Many individuals that get payday advance loan often have to take out additional loans to repay the original payday advance, capturing them in a cycle of financial obligation - bad credit financing.

The Only Guide to Bad Credit Financing

Consumers that have great backgrounds with their bank. If you're in demand of a temporary solution, you can use a currently favorable connection for financial aid.

Like personal car loans, with a residence equity financing, you'll be given the cash in a round figure. Those that require huge amounts of cash and have equity in their house Permits debtors to secure approximately 80% of their residence's worth. Because you're using your residence as security, failing on your residence equity loan may result in shedding your home.

Unlike home equity financings, HELOCs typically have variable rate of interest. Consumers who aren't certain just how much money they want and needs to be able to obtain from their house's equity over an amount of time Customers can obtain and also pay back as needed, and also recycle the line of credit scores. Considering that interest prices vary, customers might experience highly regular monthly payments.

Examine This Report on Bad Credit Financing

While many lending institutions do not allow debtors to make use of a personal car loan towards education financing, loan providers like Startup do enable for it. Those who are going after financing for educational purposes Some trainee financing lending institutions will certainly hide to the whole cost of your tuition. Some lenders have strict or unclear forbearance and also deferment programs or none in any way in instance you're not able to pay back the loan down the roadway.

Account for all personal earnings, consisting of income, part-time pay, retirement, financial investments and also rental homes. You do not require to consist of spousal support, child assistance, or different maintenance revenue unless you want it to have it considered as a basis for settling a loan. Boost non-taxable revenue or benefits included by 25%.

The deals for monetary items you see on our platform come from business who pay us. The money we make helps us provide you access to cost-free credit rating and also reports as well as assists us develop our various other fantastic devices and academic products. Settlement may factor right into look at this now just how and where products appear on our system (and in what order).

Getting My Bad Credit Financing To Work

That's why we give functions like your Authorization Chances and financial savings price quotes. Obviously, the offers on our system don't stand for all monetary products available, but our objective is to show you as numerous terrific options as we can. That does not mean you need to quit. If you need the cash for a true emergency situation expense or various other use, you can locate lenders that supply personal loans for poor credit rating.

They come with expenses, consisting of source, late and also not enough funds costs that might raise the quantity you have to repay.

The Basic Principles Of Bad Credit Financing

Feasible deals the alternative to obtain up to $500 "quickly" as well as repay your financing in 4 installations. The lending institution claims it usually disburses funds within just mins yet that it might occupy to 5 days. Feasible isn't offered in all states, so inspect if it's used where you live prior to you apply.

The application does not charge rate of interest when you pick the pay-in-four option, and there are no costs if you pay on time. If your repayment is late, you might be billed a late fee of up to 25% of the order value. The amount you can invest with Afterpay differs based on multiple aspects, including for how long you have actually been an Afterpay customer, how typically you make use of the application, your application payment history and more.

Bad Credit Financing Fundamentals Explained

, finance a residence improvement or take treatment of an emergency cost, an individual financing may aid. Below are some things to recognize if you're considering using for an individual lending with negative credit.

Here are a few Visit Website standard terms to take note of. APR is the total expense you pay each year to obtain the cash, consisting of interest and also certain charges. A reduced APR means the loan will normally cost you much less. An individual finance for a person with bad credit report will likely have a higher APR.

A lot of personal car loans need you to make fixed month-to-month payments for a set duration of time. The longer the repayment period, the more interest you'll likely pay, and the even more the car loan is most likely to cost you. Regular monthly settlements are greatly determined by the amount you borrow, your rate of interest as well as your finance term.

The Better Company Bureau knows regarding several lending institutions, and also you my sources can check the customer problem database maintained by the Customer Financial Protection Bureau to locate out if people have actually submitted grievances versus a lender you're thinking about. While getting a personal loan can be difficult and also expensive for somebody with poor credit report, loaning may make good sense in particular situations.